Please refer to important disclosures at the end of this report

1

Aptus Value Housing Finance India Ltd is an entirely retail-focused housing finance

company primarily serving low and middle-income self-employed customers in the

rural and semi-urban markets of India. Company had the highest RoA of 5.7% among

the Peer Set during the financial year 2021. It is the largest housing finance

companies in south India in terms of AUM, as of March 31, 2021. Its AUM has

increased from March 31, 2019, to Rs.4067.76Cr as of March 31, 2021, at a CAGR

of 34.54%. Additionally, Company has not restructured nor written off any loan since

inception as on Mar’21. Its total branch tally was 192 as on July 10, 2021.

Positives: (a) Presence in large, underpenetrated markets with strong growth potential.

(b) Robust risk management architecture from origination to collections leading to

superior asset quality (c) In-house operations leading to desired business outcomes

(d) Domain expertise resulting in a business model difficult to replicate by others in

our geographies (e) Experienced and stable management team with marquee

shareholders (f) Established track record of financial performance with industry

leading profitability.

Investment concerns: (a) Pandemic like Covid-19 could affect company’s business,

operations and financial conditions. (b) Any disruption in sources of capital could

have an adverse effect on the business, results of operations and financial condition

(c) Inability to meet our obligations, including financial and other covenants under

debt financing arrangement. (d) NHB’s consent to undertake the Offer is subject to

certain conditions.

Outlook & Valuation: Aptus has posted strong growth in both NII and net profits of

46.2% and 54.7% between FY19-FY21. Despite the Covid-19 crisis the company’s

asset quality has remained largely stable with GNPA and NNPA largely stable at 0.6%

and 0.5% respectively at the end of FY2021. At the higher end of the price band the

stock would be trading at P/BV of 8.5x FY21 BVPS of Rs. 41.7 which is in line with

Aavas Financers which is a comparable company. Given strong growth prospects,

and industry leading return ratios we recommend a SUBSCRIBE rating on the issue.

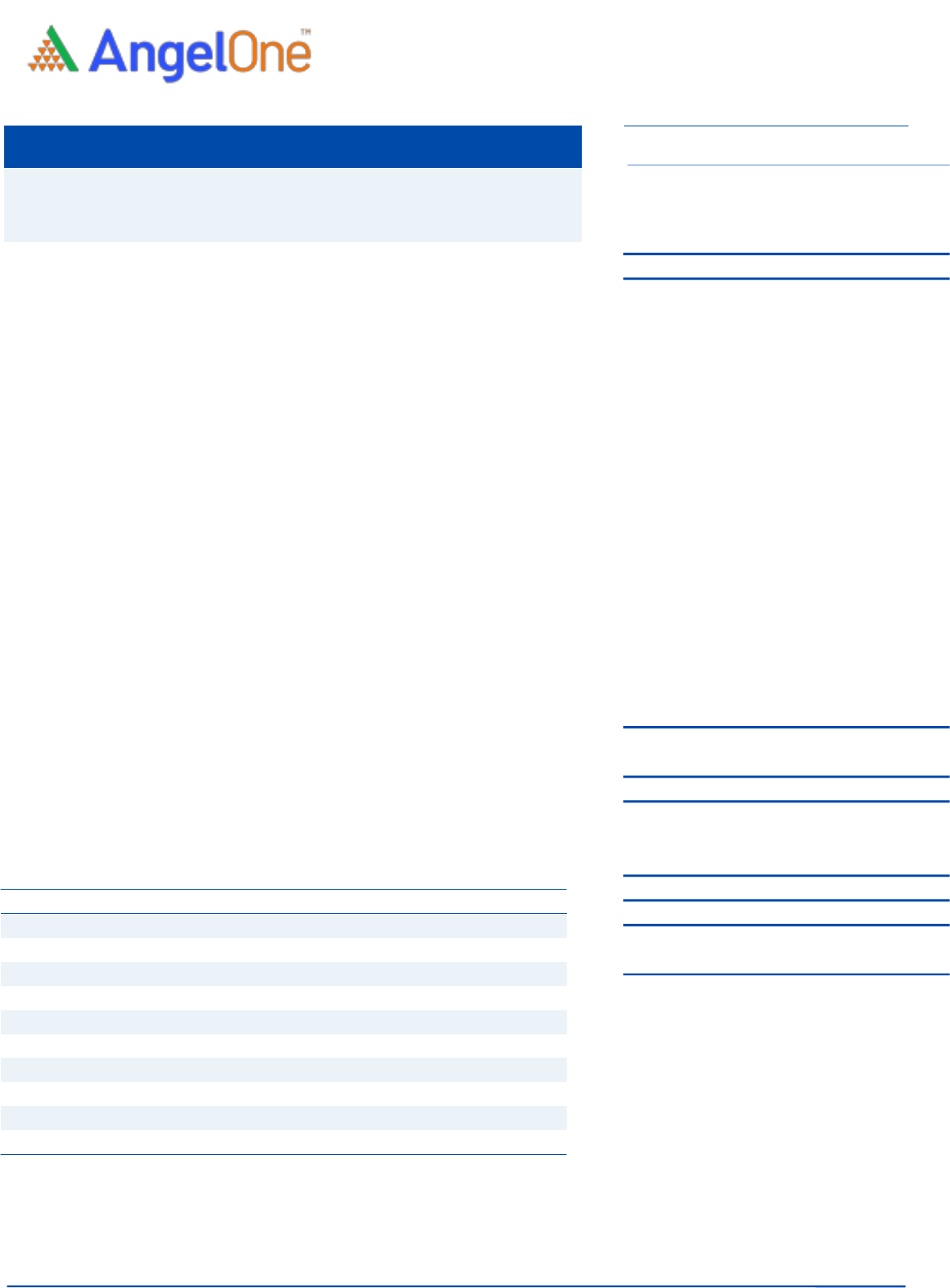

Key Financials

Y/E March (` cr)

FY19

FY20

FY21

NII

195

301

417

% chg

-

54%

39%

Net profit

111

211

267

% chg

0%

89%

27%

NIM (%)

10.3%

9.9%

10.1%

EPS (`)

2.8

4.5

5.6

P/E (x)

124.7

79.1

62.8

P/ABV (x)

20.1

9.9

8.6

RoA (%)

4.8%

5.6%

5.9%

RoE (%)

16.0%

12.3%

13.5%

Source: Company, Angel Research.

Note: Valuation ratios at upper price band.

SUBSCRIBE

Issue Open: Aug 10, 2021

Issue Close: Aug 12, 2021

Offer for Sale: `2,280 cr

QIBs 50% of issue

Non-Institutional 15% of issue

Retail 35% of issue

Promoters 72.2%

Others 27.8%

Post Issue Shareholding Pattern

Post Eq. Paid up Capital: `99.1cr

Issue size (amount): `2,735 - `2,780 cr

Price Band: `346-353

Lot Size: 42 shares and in multiple thereafter

Post-issue mkt. cap: * `17,147 cr - ** `17,494 cr

Promoters holding Pre-Issue: 74.8%

Promoters holding Post-Issue: 72.2%

*Calculated on lower price band

** Calculated on upper price band

Book Building

Fresh issue: `500 cr

Issue Details

Face Value: `2

Present Eq. Paid up Capital: `96.3 cr

Aptus Housing Finance Ltd

Aptus Housing Finance Limited |IPO Note

August 09, 2021

Aptus Housing Finance Limited | IPO Note

Aug 09, 2021

2

Company background

The company was incorporated as ‘Aptus Value Housing Finance India Limited’ at

Chennai on December 11, 2009. The Promoters of the company are M. Anandan,

Padma Anandan, and WestBridge Crossover Fund, LLC. It is entirely retail focussed

housing finance company primarily serving low- and middle-income self-employed

customers in the rural and semi-urban markets of India. They are one of the largest

housing finance companies in south India in terms of AUM, as of March 31, 2021.

The company has not restructured any loans or written-off any loans receivable as

on Mar,31 2021.

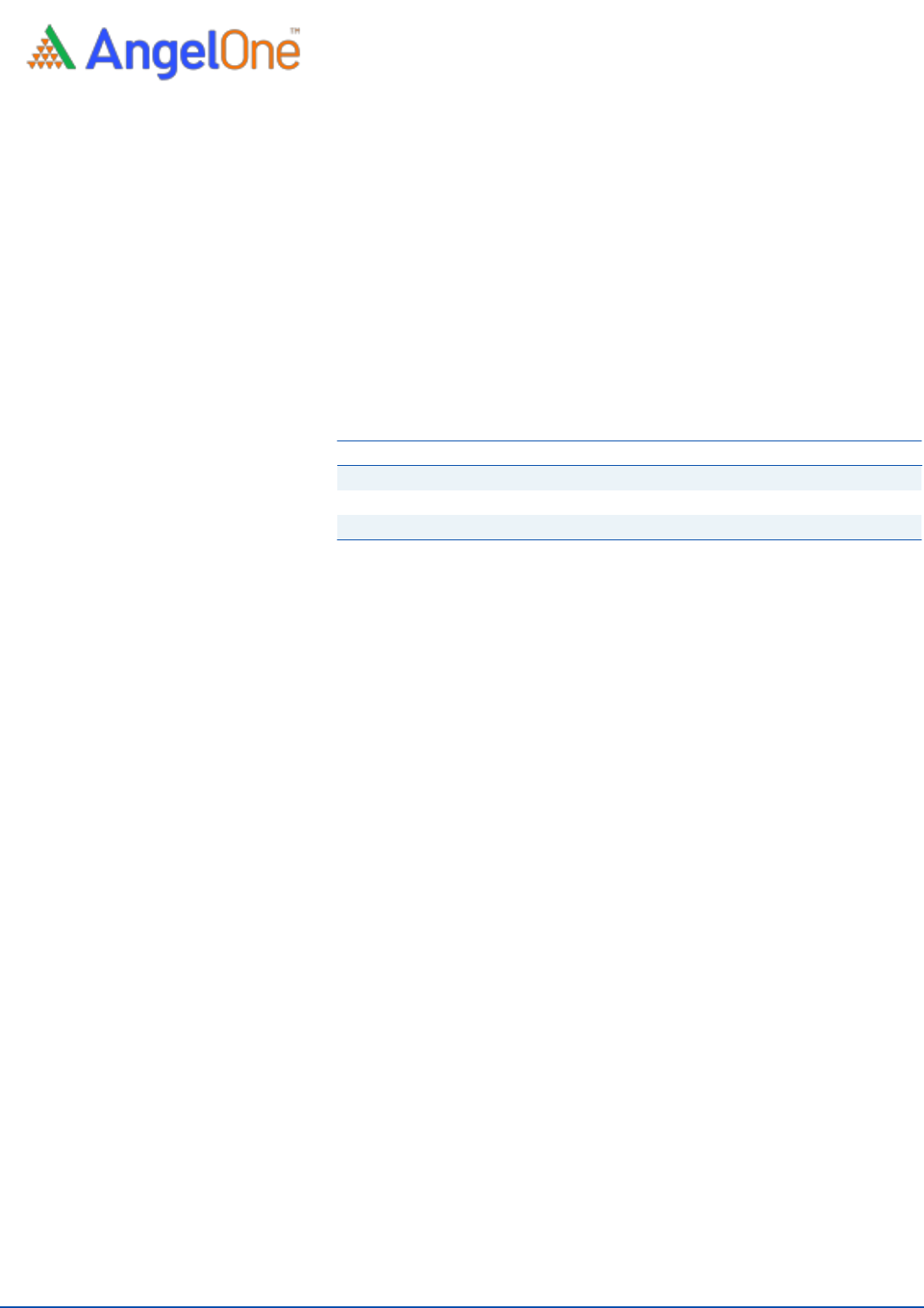

Issue details

The issue comprises of OFS of upto `2,280 crore and Fresh issue of `500 Cr.

Pre and post IPO shareholding pattern

No of shares

(Pre-issue)

%

(Post-issue)

%

Promoter & Promoter Gp.

360,436,376

74.9%

357,957,864

72.2%

Public

120,979,914

25.1%

137,622,731

27.8%

Total

481,416,290

100%

495,580,596

100.0%

Source: Company, Angel Research & RHP.

Objectives of the Offer

To augment company's capital base to meet future capital requirements.

To meet issue related expenditures.

To achieve share listing benefits on the stock exchanges.

Key Management Personnel

M Anandan is the Chairman and Managing Director of the company. He has over

40 years of experience in the financial services sector and has previously served as

the managing director of Cholamandalam Investment and Finance Co Ltd, part of

the Murugappa Group and was also managing director of Cholamandalam MS

General Insurance Co Ltd. He has served as the Chairman and Managing Director

on the Board of the company from December 11, 2009.

Kandheri Munuswamy Mohandass is the Non-Executive Independent Director of

the company. He has over three decades of experience in the financial services

sector. He is also on the board of the Subsidiary, Aptus Finance India Pvt Ltd.

Sankaran Krishnamurthy is the Non-Executive Independent Director of the

company. He was the former deputy managing director of State Bank of India,

where he served for more than 38 years. He was also the managing director

and chief executive officer of SBI Life Insurance Co Ltd. He is also on the board

of the Subsidiary, Aptus Finance India Pvt Ltd.

VG Kannan is the Non-Executive Independent Director of the company. He has

previously served as the deputy managing director of State Bank of India. He

has various years of experience in the banking industry. He is also on the boards

of AU Small Finance Bank Ltd, Ageas Federal Life Insurance Co Ltd and OCM

India Opportunities Arc Management Pvt Ltd. manufacturing, and academics.

Aptus Housing Finance Limited | IPO Note

Aug 09, 2021

3

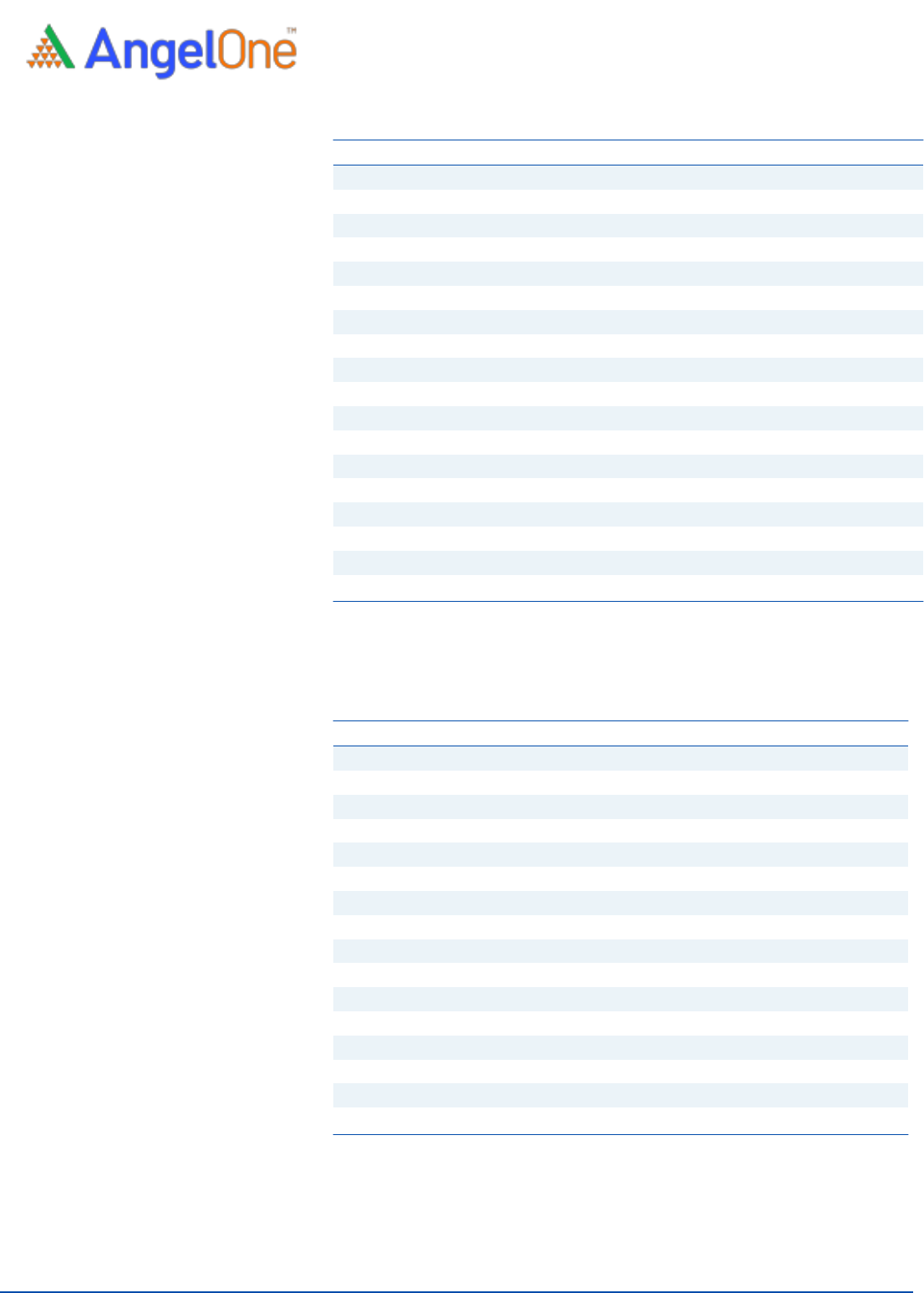

Exhibit 1: Consolidated Income Statement

Y/E March (` Cr)

FY19

FY20

FY21

Net Interest Income

195

301

417

- YoY Growth (%)

-

54.5%

38.8%

Other Income

26

38

31

- YoY Growth (%)

-

46.8%

-18.5%

Operating Income

221

339

449

- YoY Growth (%)

-

53.5%

32.3%

Operating Expenses

67

88

98

- YoY Growth (%)

-

32.0%

10.6%

Pre - Provision Profit

154

251

351

- YoY Growth (%)

-

62.9%

40.0%

Prov. & Cont.

1

3

6

- YoY Growth (%)

-

192.6%

69.5%

Profit Before Tax

153

247

345

- YoY Growth (%)

-

61.9%

39.5%

Prov. for Taxation

41

36

78

- as a % of PBT

-

-12.0%

115.4%

PAT

111

211

267

- YoY Growth (%)

89.3%

26.5%

Source: Company, Angel Research

Exhibit 2: Consolidated Balance Sheet

Y/E March (` Cr)

FY19

FY20

FY21

Equity

79

95

95

Reserve & Surplus

620

1,615

1,885

Networth

698

1,709

1,979

Borrowings

1,601

2,016

2,510

- Growth (%)

-

26%

25%

Other Liab. & Prov.

29

22

31

Total Liabilities

2,328

3,747

4,520

Cash Balances

107

484

423

Bank Balances

4

119

15

Investments

-

-

53

Advances

2,200

3,117

3,990

- Growth (%)

42%

28%

Fixed Assets

10

10

10

Other Assets

6

17

30

Total Assets

2,328

3,747

4,520

- Growth (%)

61%

21%

Source: Company, Angel Research

Aptus Housing Finance Limited | IPO Note

Aug 09, 2021

4

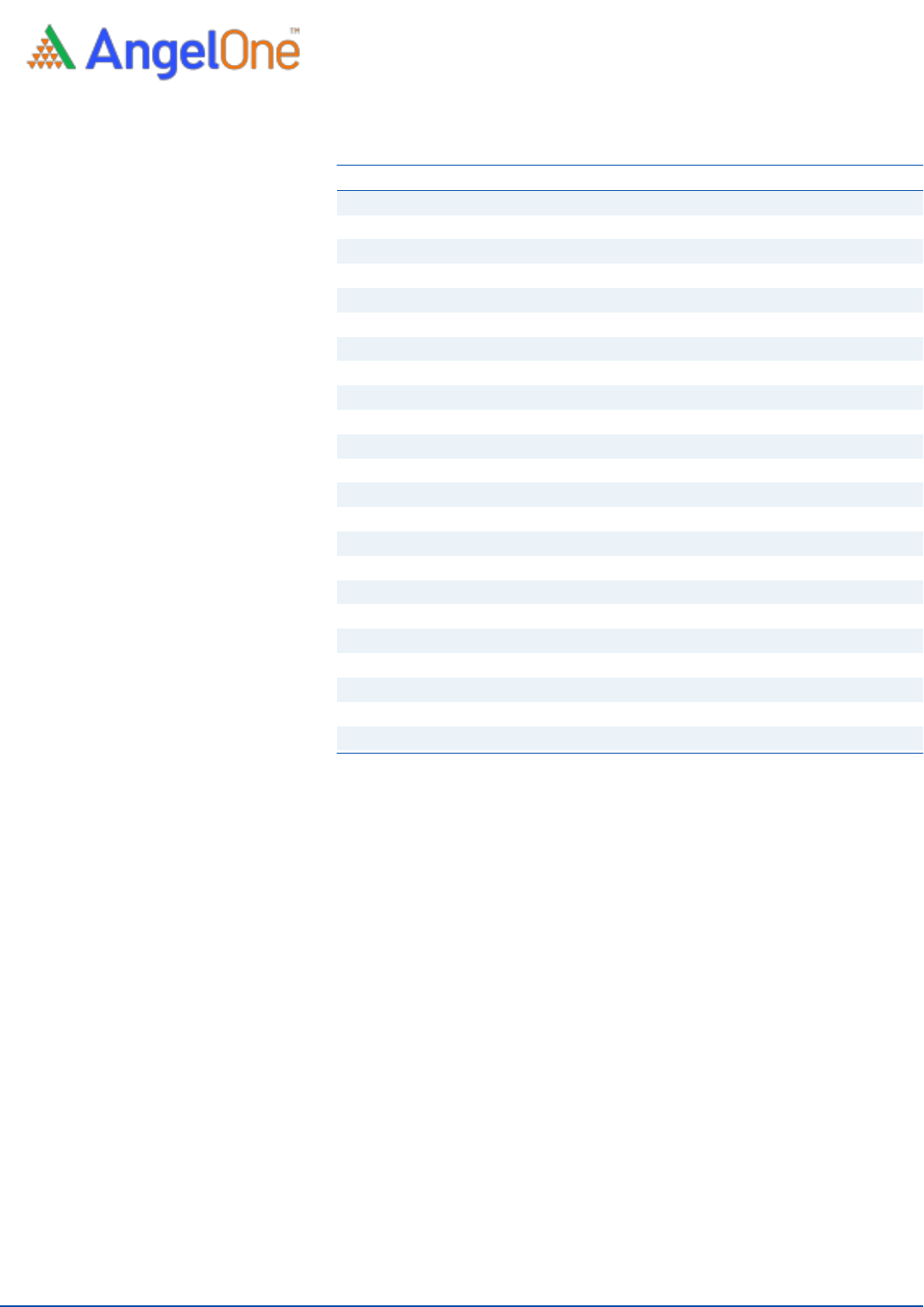

Key Ratios

Y/E March

FY19

FY20

FY21

Profitability ratios (%)

NIMs

10.3%

9.9%

10.1%

Cost to Income Ratio

30.3%

26.1%

21.8%

RoA

3.0%

4.7%

5.9%

RoE

16.0%

12.3%

13.5%

B/S ratios (%)

CASA Ratio

-

-

-

Credit/Borrowings Ratio

137.5%

154.6%

159.0%

CAR

43.6%

82.5%

73.6%

Tier I

43.2%

82.3%

73.8%

Asset Quality (%)

Gross NPAs

0.9%

0.7%

0.6%

Net NPAs

0.7%

0.5%

0.5%

Loan Loss Prov. /Avg. Assets

0.1%

0.1%

0.1%

Provision Coverage

25%

24%

22%

Per Share Data (`)

EPS

2.8

4.5

5.6

BVPS

17.7

36.2

41.7

ABVPS

17.7

36.1

41.7

DPS

-

-

-

Valuation Ratios

PER (x)

124.7

79.1

62.8

P/ABVPS (x)

19.9

9.8

8.5

Source: Company, Angel Research

Aptus Housing Finance Limited | IPO Note

Aug 09, 2021

5

Research Team Tel: 022 - 39357800 E-mail: [email protected] Website: www.angelbroking.com

DISCLAIMER

Angel Broking Limited (hereinafter referred to as “Angel”) is a registered Member of National Stock Exchange of India Limited, Bombay

Stock Exchange Limited and Metropolitan Stock Exchange Limited. It is also registered as a Depository Participant with CDSL and Portfolio

Manager and investment advisor with SEBI. It also has registration with AMFI as a Mutual Fund Distributor. Angel Broking Limited is a

registered entity with SEBI for Research Analyst in terms of SEBI (Research Analyst) Regulations, 2014 vide registration number

INH000000164. Angel or its associates has not been debarred/ suspended by SEBI or any other regulatory authority for accessing

/dealing in securities Market. Angel or its associates/analyst has not received any compensation / managed or co-managed public

offering of securities of the company covered by Analyst during the past twelve months.

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should make

such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the companies

referred to in this document (including the merits and risks involved), and should consult their own advisors to determine the merits and

risks of such an investment.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and

trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's

fundamentals. Investors are advised to refer the Fundamental and Technical Research Reports available on our website to evaluate the

contrary view, if any.

The information in this document has been printed on the basis of publicly available information, internal data and other reliable sources

believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this document is for

general guidance only. Angel Broking Limited or any of its affiliates/ group companies shall not be in any way responsible for any loss

or damage that may arise to any person from any inadvertent error in the information contained in this report. Angel Broking Limited

has not independently verified all the information contained within this document. Accordingly, we cannot testify, nor make any

representation or warranty, express or implied, to the accuracy, contents or data contained within this document. While Angel Broking

Limited endeavors to update on a reasonable basis the information discussed in this material, there may be regulatory, compliance, or

other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced,

redistributed or passed on, directly or indirectly.

Neither Angel Broking Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from or in

connection with the use of this information.